Making Tax Digital for VAT

If you are VAT registered, you need to be fully compliant for your first VAT return starting on or after 1 April 2022.

Making Tax Digital (MTD) means fundamental changes to the way the tax system works. HMRC’s ambition is to become one of the most digitally advanced tax administrations in the world. In the short term this means businesses like yours will be required to make, preserve and then submit your existing tax records digitally.

Businesses are increasingly seeing the benefits of digitisation. Millions of businesses are already banking, paying bills and interacting with their customers or suppliers online, and many are already using accounting software.

‘Making Tax Digital’ integration should eliminate many of the existing paper-based processes. This should mean that businesses can devote more time and attention to maximising business opportunities, but it will need companies to embrace good financial planning.

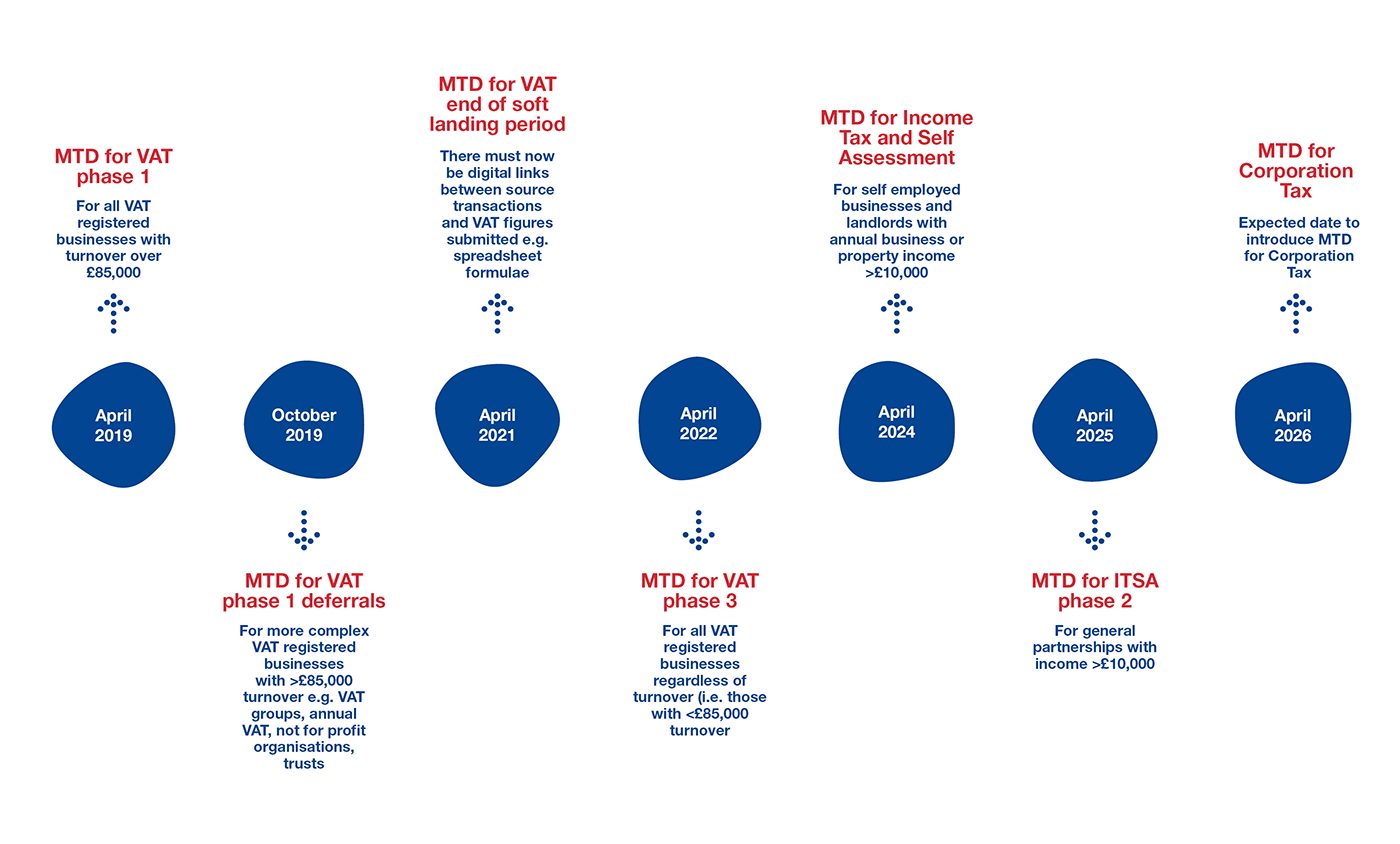

The MTD Timeline

Click on the above timeline to enlarge

April 2022: All VAT-registered businesses and organisations whatever their turnover will be required to keep their VAT records digitally and send their VAT returns using functional compatible software.

April 2024: MTD for income tax self assessment (ITSA) – self-employed businesses and landlords with business or property income over £10,000 will need to follow the MTD rules from this date (delayed from April 2023)

April 2025: Partnerships with business or property income that only have individuals as partners will need to keep their business tax records digitally and send quarterly summaries of their income and expenses to HMRC using functional compatible software. This will be mandatory, but again will only apply to those with business income (turnover plus gross rental income) over £10,000.

As with the introduction of MTD for VAT where there was a delay in the introduction for more complex entities, the April 2025 date does not include more complex partnerships – not LLPs / mixed or corporate partnerships. No date has been announced for the introduction to this group.

April 2026: With the delays to MTD ITSA being announced it is now unknown if the MTD for corporation tax will now take place in 2026. We will keep you informed, but there is no doubt that it will come into force at some point. Incorporated businesses will need to keep their business tax records digitally and send quarterly summaries of their income and expenses to HMRC using functional compatible software. MTD for corporate tax is expected become mandatory from this date.

MTD for VAT – How can we help?

Now is the time to get ready for MTD for VAT which will affect your first VAT return period starting on or after 1 April 2022.

Step 1. Read our FAQ’s below to understand how MTD will affect your business. Speak to your client services manager to explore the options which best suit your business needs while assisting you to be MTD compliant

Step 2. Our client services and specialist VAT team can help you understand the process for keeping digital records, with digital links through to the digital submission of your VAT returns.

Step 3. Know when you need to be compliant and how to sign up for MTD for VAT.

MTD and Cloud Accounting

Where it’s right for the business our recommendation is a move to Cloud Accounting. MTDfV, MTD ITSA and Cloud Accounting are a real opportunity to truly digitalise the way you work.

There are a variety of products on the market that provide benefits beyond the basic bookkeeping functionality that can really benefit a business. It can deal with the removal of the manual entry of invoices and bank transactions, to giving you electronic payment solutions, automating debt collection, and industry specifics such as property management, manufacturing and wholesale stock tools, webshop and till systems, etc.

Cloud Accounting with PKF Francis Clark is about more than just software, it’s a way of working together to achieve your business goals. With remote log-in we’ll be able to guide your business and spot potential issues or tax planning opportunities early on. Access to real-time, business critical information allows you to spot patterns and trends quickly and take advantage of them.

Making Tax Digital ITSA Pilot

The Making Tax Digital for Income Tax pilot is already available on a voluntary basis. If your business signs up to MTD and has no other reportable income they will no longer be required to complete a self-assessment return.

There are currently no proposals to change the dates by which taxes have to be paid or how they are accounted for, but this has been discussed by HMRC with accountants and businesses and the Chancellor has announced a new points-based penalty system which will apply to returns and payments under MTDfV from 1 April 2022 and no doubt these will be rolled out to other areas once established.

Could we be looking at a situation within the next 10 years where businesses will be paying a monthly or quarterly sum to HMRC for all their business tax liabilities?

Get in touch

Meet our Making Tax Digital experts: