What happens when you decide that you would like to exit your owner-managed business? Perhaps you’re doing so to retire or take a career break or…

The challenges of rising costs in tourism and hospitality

Last month, the Bank of England increased interest rates another 0.5%, on top of the 0.25 percentage points the month before, to 5%, its 13th consecutive increase. The chief executive of UKHospitality has already warned the increased costs could “significantly impact” the viability of the hospitality sector and further rate rises are forecast through the rest of this year.

Sector struggles

Although each sector has its own challenges, the hospitality sector saw the biggest hit during the pandemic, with a large number of businesses forced to take out loans to survive. However, now those loans are due, repayment is not the only cost pressure businesses are contending with. The government needs to take immediate action to assist businesses with their pandemic debt.

Whilst energy and labour costs are issues across the sector, and, to some extent, increased prices can mitigate, increases in financing costs will depend upon borrowing levels, meaning that highly geared businesses are facing costs that competitors are not. To contextualise this, a hotel with £2m of debt is looking at additional costs of just under £100,000 per year.

The latest ONS business insights survey shows that almost 98% of businesses in the hospitality industry have concerns for the survival of their business, compared to 75% of firms in the wider economy. This confirms that three quarters of all businesses in the UK are worrying about the future of their business, but businesses in the hospitality sector are by far the most unsure.

Business Rates Relief

An area where the government has provided much needed support for the sector is with its new Business Rates Relief Scheme for retail, hospitality, and leisure properties. The scheme allows eligible ratepayers to receive 75% relief on their business rates bills for the year 2023/24, up to a maximum cash cap of £110,000. The aim is to help businesses that make the high street and town centres thrive. Eligible establishments include hotels and guest houses, restaurants, pubs, coffee shops, live music venues, and tourist attractions. We know that this is effectively a saving of about 2% of turnover based on standard trading levels, which goes some way to offsetting increased borrowing costs.

An economic boost

The travel, hospitality and leisure industry contributes a substantial amount to the UK economy every year. According to the Department for Digital, Culture, Media and Sport’s Tourism Recovery Plan (2021) tourism contributed £74.5b to the UK economy in 2019.

In recent years, the South West is usually top of the list for leisure trips destinations in the UK. In 2019, the South West totalled to £4.1b of the annual expenditure from tourism in England. Whereas, in April-December 2021, the South West totalled to £4.5b of expenditure from tourism in England. Both times were the highest of any English region. (Statistics derived from the Great British Tourist Reports of 2019 and 2021)

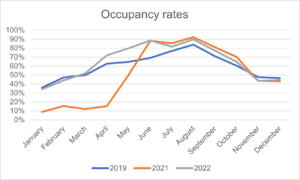

Rise in South West occupancies

The same rise can be seen in our South West Hotel Occupancy Tracker, which has evaluated a cross-section of hotels for the last 20 years. The graph below compares hotel occupancies over the past two years with those in the last pre-pandemic year of 2019. The line depicting occupancies in 2021 shoots up around the time of the G7 summit in June. The line then continues to follow a similar pattern to 2019, albeit slightly higher until the winter months. The trend continues also into 2022, which is also reportedly higher than occupancy rates in 2019.

Another notable impact of the pandemic is that it led to many UK consumers exploring different parts of the UK for the first time – a positive for the leisure, tourism, and hospitality industry. According to the Tourism Recovery Plan, 58% of tourism businesses in the South West reported an increase in first-time visitors over the summer of 2020 (p. 33).

On top of this, the dualling of the A30 Chiverton to Carland Cross is in progress to boost Cornwall’s economy for tourism. Journeys on this stretch of the road are regularly delayed, and congestion often brings traffic to a standstill. This is a significant investment, which was first called for in 1989 (Public Engagement Report, p. 6).

Although the road ahead is not clear, there is great prosperity for the South West leisure, tourism and hospitality industry in the future. Our business advisers are here to assist your company overcome any problems with costs of debt servicing and make it through the period of higher costs. Get in contact today to see how we can help.