TOMS is a special scheme for businesses that buy in and resell travel, accommodation and certain other services as a principal or undisclosed agent acting in…

Client interest increase may create a VAT cost for your law firm

For most, the rising interest rates announced by the Bank of England in May 2023 would not have been welcome news. However, this could be good news for those with funds accruing interest in bank accounts.

Law firms are benefiting significantly by the interest rate increases, as most law firms to hold significant amounts of client monies in interest bearing accounts.

Funds held in designated client accounts, including any interest earned on those funds, are considered to be the client’s own money and any movement of such funds and interest would be outside the scope of VAT.

In contrast, where client money is held in a general account, and the practice is entitled to retain any interest earned, this is exempt income in the hands of the law firm.

Where a business receives both taxable (e.g fees to clients) and exempt income (e.g interest on client funds), they will be partly exempt for VAT purposes, with calculations required to establish the value of VAT to be reclaimed from HMRC on its costs.

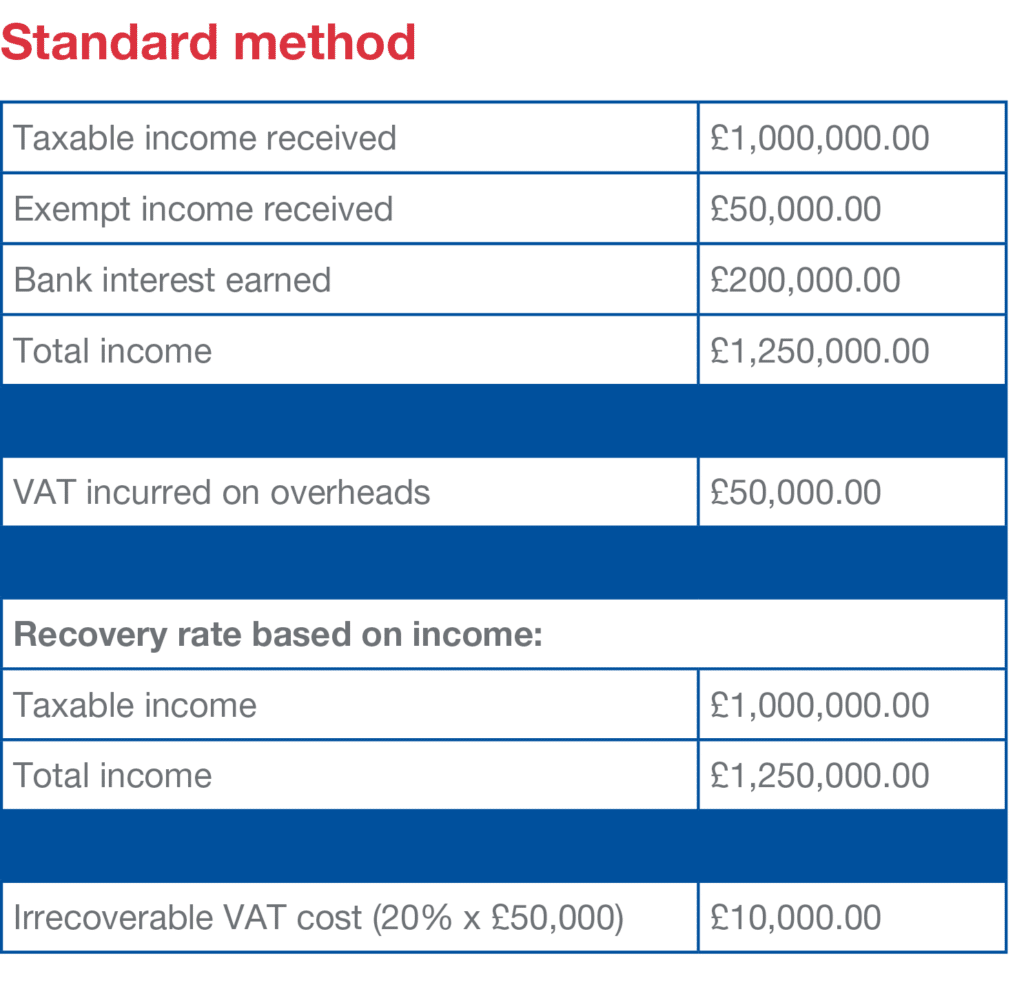

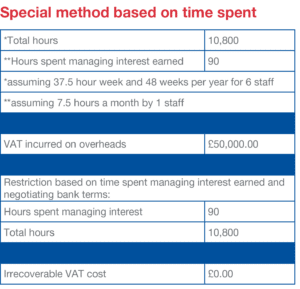

VAT on costs wholly relating to making taxable supplies (e.g fees) will be fully recoverable, whilst VAT wholly incurred in relation to exempt income earned (e.g client interest) will be irrecoverable in most cases. The remaining VAT incurred on overhead costs will depend on the value of taxable income compared to total income (known as a partial exemption calculation) unless an alternative ‘special’ method for the calculation is agreed with HMRC in writing.

When carrying out the partial exemption calculations, for the purposes of exempt income, financial transactions which are incidental to the main business activities are to be excluded. However, HMRC consider interest earned on client money held for the purposes of their ordinary business activities cannot be treated as incidental income and must be included in the calculations.

If the retained interest earned is a significant amount, this may result in a restriction of VAT incurred on the firm’s overhead costs. It may therefore be worth considering agreeing a special method with HMRC or reviewing any previously agreed method given the rates increase if this has had a significant impact on the business.

Time to review your partial exemption method?

Given the recent increases in bank interest rates, it may be worth revising your current VAT partial exemption method.

An increase in the amount of interest earned on client money held in general undesignated accounts could have a significant impact on your VAT recovery position.

The value of interest retained will likely be seen by HMRC as exempt income and not incidental, therefore potentially reducing the recovery percentage on overhead costs for any income-based method.

You may have been entitled to full recovery under the ‘de minimis limit’, where the total VAT on costs related to exempt activities is less than half the total VAT incurred and £7,500 a year, but the rates increase could cause you to breach the limit resulting in a repayment of exempt input tax incurred in the year and future returns.

Even where you have previously agreed a special method with HMRC in writing, all written methods include a clause requiring the method to be reviewed should the business experience any significant changes. If the rates increase will significantly impact the business, you will need to consider this and either agree a new method or document the reasons why your existing method still produces a fair and reasonable recovery of input tax.

Here are some examples to demonstrate the effect this could have on your VAT recovery position and how a method based on, for example, time involved in generating that interest income through negotiating and reviewing bank terms, could improve the recovery position.

If you have any doubt whether your practice will be affected by the above, contact Ross Bond our VAT expert for professional practices, or your local contact for a conversation.