TOMS is a special scheme for businesses that buy in and resell travel, accommodation and certain other services as a principal or undisclosed agent acting in…

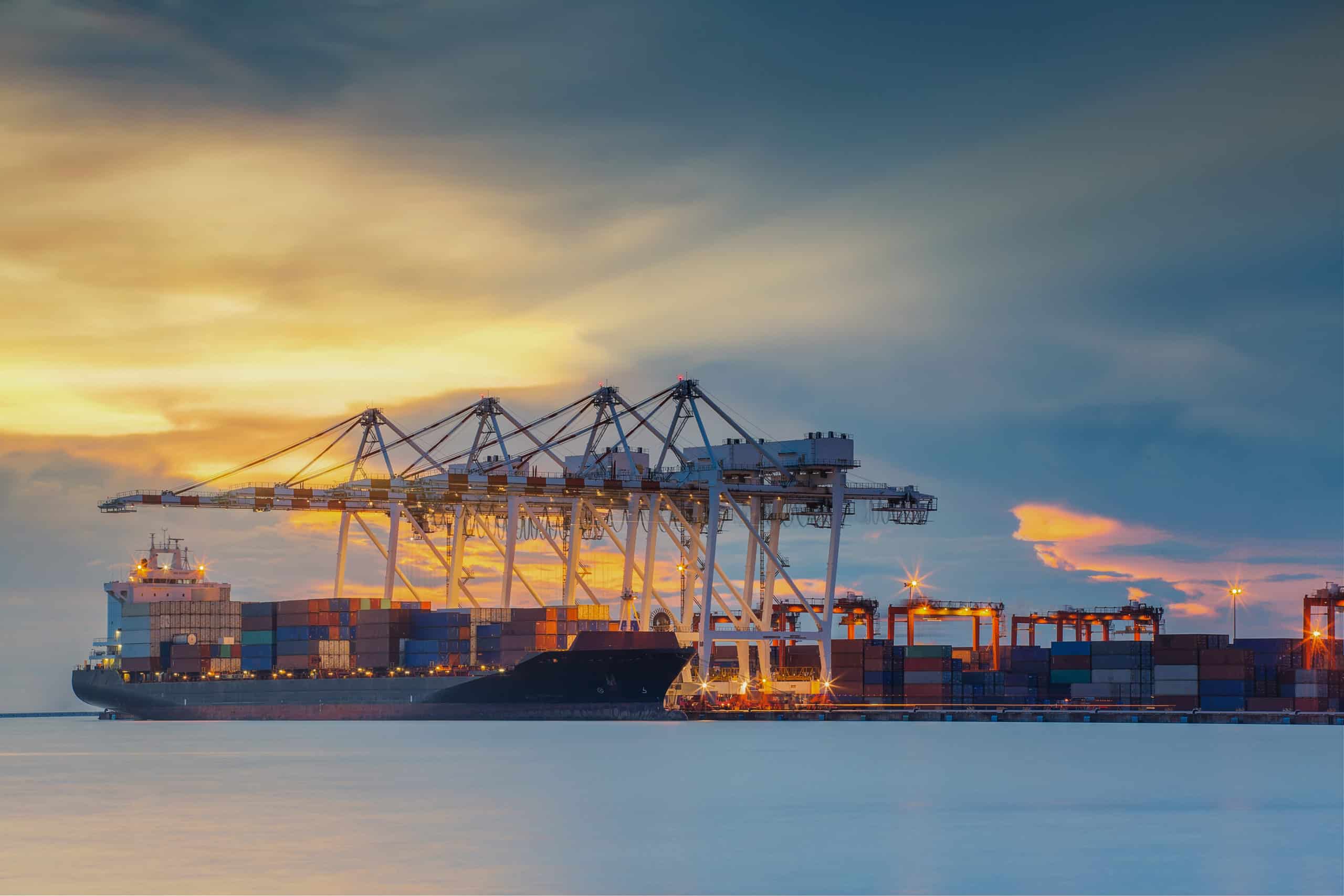

Selling to the world – current trends in international trade

This article was first published in South West Business Insider magazine.

You receive an order from a customer in Wellington, but where exactly are they located? A few decades ago, the answer may have been obvious, but in our ever more interconnected world, it has never been more likely that your customer is in the New Zealand capital, rather than the Somerset market town.

Globalisation, international markets and cross-border supply chains bring new considerations, challenges and opportunities. Official figures show South West imports and exports have experienced consistent yearly growth. It has never been more important for Westcountry businesses to understand these trends and untap the potential of international trade.

New agreements

Free trade agreements (FTAs) enable countries to offer favourable terms to trading partners that reduce or remove duties, thereby opening new markets for suppliers and customers. The recent enactment of FTAs with Australia and New Zealand represents an important step as the UK seeks new partners (such as The Gulf Cooperation Council) and looks to renegotiate its EU rolled-over agreements on more favourable terms.

New agreements bring immediate savings to business; rules and requirements can vary significantly between countries. However, domestic suppliers will face greater competition from overseas competitors. Nowhere is this more apparent than the South West’s vital food and agricultural sector. The new FTAs will initially maintain quotas on sensitive products – including beef, lamb and cheese – but these will ultimately be removed.

New controls and systems

UK import declarations are now processed through the HMRC Customs Declaration Service, with exports due to follow suit, while the Government’s plan for a “single trader window” will allow traders to access various services, reliefs and facilitate compliance. UK border policy will imminently be adjusted to amend controls and bring new certification requirements for certain products. Imports of EU products will be more closely aligned with those from the rest of the world, but bring new costs, considerations and border checks.

Environmental concerns

Growing environmental concerns have led to new taxes and policies. The UK Plastic Packaging Tax was introduced last year and increases costs for manufacturers and importers. In the EU, the Carbon Border Adjustment Mechanism will introduce fees for the import of carbon intensive products. The UK Government is currently consulting on a British equivalent, along with mandatory product standards and new emissions reporting.

Using reliefs

The Plymouth and Solent Freeports will offer a range of benefits to businesses within their borders, however for many there is no need to wait. Existing reliefs, such as inward processing and customs warehousing, are already available to remove duties and irrecoverable VAT from supply chains and are increasingly being applied for by businesses looking for a competitive edge.

Whether you are a startup looking to make your first import or a multinational with global supply operations, the PKF Francis Clark customs team can provide tailored advice to support the growth and resilience of your business in an ever-changing world.

Find out more about how our VAT, customs and indirect taxes experts can help.

FEATURING: Mike Frost

Mike is an Indirect Tax Consultant specialising in Customs Duty and International Trade. He assists clients with solutions to all manner of customs queries and… read more