Making Tax Digital For Income Tax Self-Assessment

HMRC has announced a phased mandation for MTD for ITSA with changes to the implementation dates and income thresholds. Find out more in our blog post here.

What is Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA)?

Put simply, Making Tax Digital for Income Tax means:

- Keeping transactional records digitally

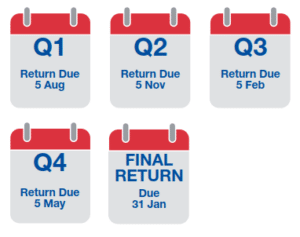

- Submitting these records quarterly to HMRC

From April 2026, income tax returns and self-assessments will need to be digitally recorded and submitted quarterly instead of annually, through Making Tax Digital compliant software.

This means that, for many, there will be a big change in adapting to new ways of working, adapting to new digital software.

The new process will mean:

There will be no change to tax payments and the deadlines for these. VAT returns should also be filed separately.

Who is affected by MTD for ITSA?

From April 2026

- Landlords (UK and overseas) with rental income greater than £50,000 per year

- Sole Traders and self-employed businesses with income greater than £50,000 per year

The above threshold relates to the sum of the businesses e.g. an individual who has self-employment income below £50,000 may have property income that in total pushes them over £50,000 per annum.

From April 2027

Landlords and Sole Traders with annual income between £30,000 and £50,000.

Who will NOT be affected by MTD for ITSA?

Other types of partnership, including Limited Liability Partnerships (LLPs), that are not general partnerships with only individuals as partners, such as:

- Trusts and estates

- Trustees of registered pension schemes

- Non-resident companies

Get ready for MTD for ITSA

Step 1 – Are you affected?

Identify whether you are affected by MTD for Income Tax and which of the above deadlines affects you or your business.

Step 2 – Potential exemptions

Apply for an exemption if you are eligible and don’t wish to comply. If you already have an exemption from MTD for VAT, your exemption will flow through to other taxes automatically.

Step 3 – Bank accounts

Separate your business banking from your personal banking now if you haven’t already done so, to begin practicing the habit of separation. This is because you won’t want to provide HMRC or your accountant with all your personal records mixed in.

Step 4 – Tax basis reform

The periods for which your income tax is assessed will change from 2025-26, so that all ITSA returns from 6 April 2026 will be submitted based on the same quarter-ends. This may trigger an increased tax liability if you don’t already have a 31 March or 5 April year end.

Please speak with your tax advisor if you think you could be affected.

Step 5 – Digital software

If you’re using digital software already, ask their support team if they will be MTD compatible.

Otherwise speak to your adviser about software options that are the best for your business and that you feel comfortable using e.g. Xero, Quickbooks or Hammock (the latter being created especially for property bookkeeping for landlords).

Step 6 – Support

Get in touch with your accountant to discuss what you’ll need support with – from help with setting up your software, checking your tax returns, submitting them to HMRC, or dealing with the entire quarterly submission process for you.

How Can PKF Francis Clark Help?

PKF Francis Clark has helped transition over 4,000 VAT registered clients to the new Making Tax Digital compatible software. This means that we have proven experience in supporting our clients in the transfer of their software, whilst keeping in touch with them at every step.

We have a dedicated Digital Accounting Team who focus on staying up to date with the latest software and technologies, engaging with software vendors for best practice, researching the very latest accounting technology and training teams internally to drive the best service and support for their clients.

Get in touch

Related Tax Services